Corporate governance

Our approach to corporate governance

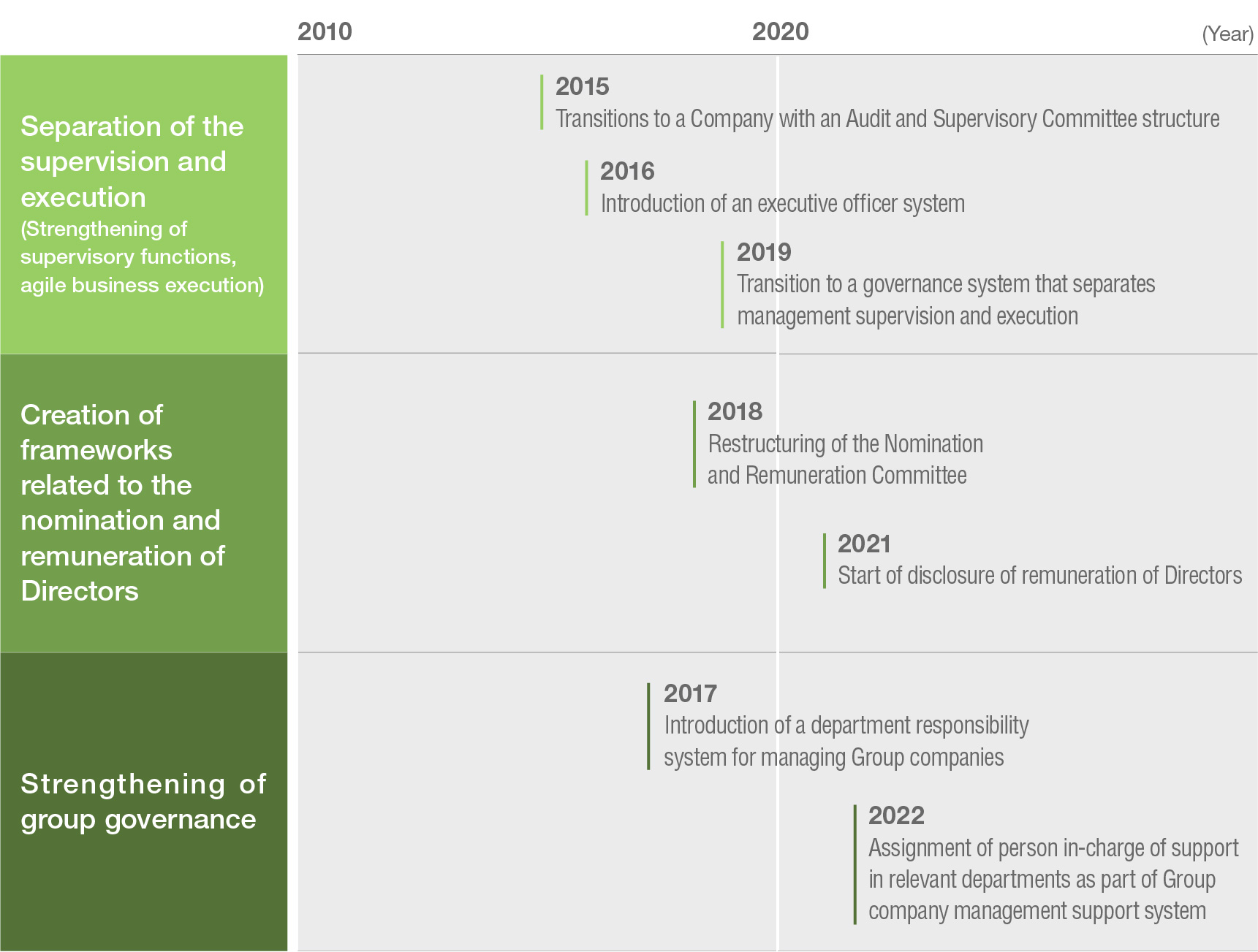

In order to enhance our corporate value over the long term in a rapidly changing business environment, we aim to build good relationships with a wide range of stakeholders and achieve sustainable development. We realize that, to achieve this goal, we strengthen our corporate governance by establishing a governance framework based on independence, objectivity, and transparency of management, and implementing various initiatives. In 2015, Sangetsu transitioned to become a company with an Audit and Supervisory Committee, with the aim of strengthening the auditing and supervisory functions with respect to the Board of Directors by having outside directors participate in management.

Company’s Corporate Governance Report

-

download all pages

(563KB)

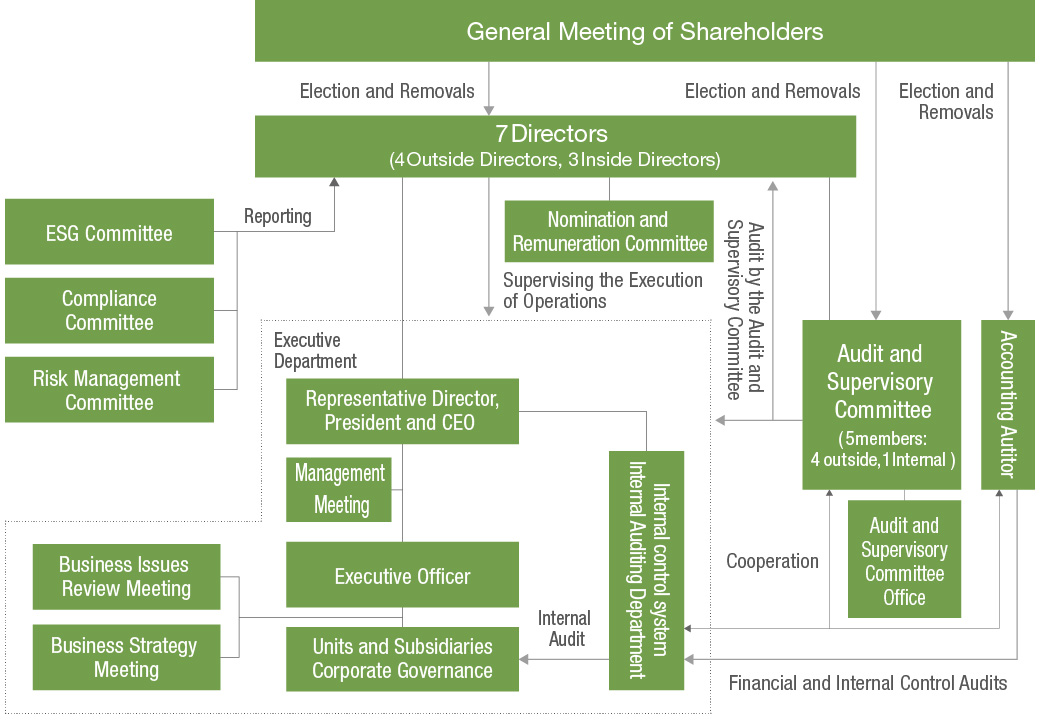

Corporate Governance System

In order to strengthen the independent, objective oversight of the Board of Directors, Sangetsu has adopted a new corporate governance system and management system that separates the “supervision” and the “execution” of management. We also altered the composition of the Board in FY2019 to include two directors who hold a concurrent position as executive officers, and five directors who concurrently serve as Audit and Supervisrory Committee Members. This aims not only to enhance auditing and supervision of business execution, but to promote active discussion from the perspective of shareholders. Meanwhile, we have established a system designed to increase the transparency of management by stipulating that accounting auditors, who are usually reappointed, have a maximum term limit of 10 years. This is to ensure a higher degree of independence and appropriate external auditing.

Corporate Governance System Chart

Changes to Strengthen Governance System

Board of Directors

Board of Directors of the Company perform duties such as resolutions for items stipulated under law and items that require important decision-making for the Company, and establishing corporate strategies. All or part of the decision-making responsibilities regarding the execution of certain operations have been delegated to the Representative Director (President and CEO). The Board of Directors monitors the progress of delegated matters.

The Board of Directors consists of four independent outside directors and three internal directors who meet at least once a month. Resolutions require attendance by a majority of the Directors and a vote of approval by a majority of the Directors in attendance.

Contents of Primary Discussions by Board of Directors

|

Discussion Theme |

Specific Contents of Discussion |

|

Internal control and risk management |

The Risk Management Committee, which conducts reporting and discussions concerning internal control and risk management, also engages in discussions regarding the status of activities by the Compliance Committee at the Board of Directors and monitors the status of internal control activities and operation status of risk management throughout the Group. |

|

ESG |

Based on the ESG and CSR Policies touted by the Company, we provide reporting to and discussions at the Board of Directors regarding the status of activities by the ESG Committee and about initiatives investigated and executed by the Committee, with the aim to achieve supervision and monitoring by the Board of Directors. |

|

Corporate strategies |

In this fiscal year, we revised the Long-term Vision [DESIGN 2030] and formulated and published our new Medium-term Business Plan [BX 2025]. In the first fiscal year of the Plan, Executive Officers conducted three reports on the current status and problems in each business and engaged in discussions to achieve objectives. |

|

Revision of remuneration system |

Due to issues pertaining to changes in the economic situation and in the profitability and share price level of the Company, and pertaining to the fixed remuneration portion, we revised this system through discussions at the Nomination and Remuneration Committee during the formulation of the Medium-term Business Plan [BX 2025]. |

|

Revision of Corporate Philosophy |

While we continue to investigate business reforms and new growth strategies, we have revised our Corporate Philosophy, as the one we established at our founding is not in line with the Company’s current approaches and intended directionality. |

|

Succession of President and CEO, Executive Officer and medium- to long-term succession plan |

With regards to the succession of the President and CEO, Executive Officer, we have held discussions concerning succession nominees and the nomination process based on our Corporate Governance Code. |

|

Investigation of M&A |

We have investigated specific items related to M&A strategies for realizing growth strategies. We have held multiple discussions and made resolutions concerning the position of profitability and risks as well as for the measures there against. |

Skill Matrix

With regards to the experience and knowledge expected of Directors and Audit and Supervisory Committee Members, we have established, for the growth of the Space Creation Company, a skill matrix based on fundamental management skills, expertise in divisions at the Company, as well as the skills necessary for growth.

| Name | Current Position and Role at Sangetsu Corporation |

Attributes | Tenure | Audit and Supervisory Committee Member |

Nomination and Remuneration Committee Member |

Experience and insight expected from Directors | Attendance at Board Meetings |

|||||||||||

| Experience and insight for basis of management |

Expertise in line with the Company’s businesses and experience and insight necessary for growth |

|||||||||||||||||

| Corporate management |

Finance/ Accounting |

Legal Affairs/Risk management |

Human resources strategy |

DX/IT | Sustainability/ ESG |

Industry knowledge |

Development /Quality |

Sales/ Marketing |

Supply chain management |

Global business |

Business model innovation and transformation |

|||||||

| Yasumasa Kondo |

|

Executive | 2 year | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 100% (14/14) |

|

| Yutaka Matsuo |

|

Executive | ● | ● | ● | ● | ||||||||||||

| Michiyo Hamada |

|

|

10 year | ● | ● | ● | ● | ● | ● | 100% (14/14) |

||||||||

| Kenichi Udagawa |

|

|

6 year | ● | ● | ● | ● | ● | ● | ● | ● | ● | 100% (14/14) |

|||||

| Osamu Terada |

|

|

4 year | ● | ● | ● | ● | ● | ● | ● | ● | ● | 100% (14/14) |

|||||

| Aki Ogane |

|

|

● | ● | ● | ● | ● | ● | ● | ● | ||||||||

| Yosuke Mine |

|

Nonexecutive | ● | ● | ● | ● | ● | ● | ||||||||||

Our approach to the skills required for Directors

|

Name of skill |

Reason necessary |

|

Corporate management |

In order to achieve sustainable growth and enhance corporate value over the medium to long term, it is necessary to have Directors with extensive insight and experience in management as top executives. |

|

Finance/Accounting |

In order to effectively supervise financial strategy and accounting procedures, etc. and improve the reliability of various financial decisions, it is necessary to have Directors with extensive insight and experience in finance and accounting. |

|

Legal Affairs/Risk management |

In order to establish a sincere and highly transparent system for compliance with laws and regulations and a risk management system, which form the foundation of corporate activities, it is necessary to have Directors with extensive insight and experience in legal affairs, compliance, and risk management. |

|

Human resources strategy |

The driving force behind the promotion of growth strategies is “human resources,” and it is necessary to have Directors with extensive insight and experience in human resources strategy in order to maximize the value of human capital. |

|

DX/IT |

In order to respond appropriately to changes in the business environment and achieve strengthening of competitiveness and creation of new value, strategic utilization of digital technology is essential, and it is necessary to have Directors with extensive insight and experience in DX and IT. |

|

Sustainability/ESG |

In order to realize a sustainable circular society, respond appropriately to environmental and social issues, and achieve sustainable growth as a company, it is necessary to have Directors with extensive insight and experience in sustainability and ESG. |

|

Industry knowledge |

In order to transform into a Space Creation Company and expand the business domain, it is necessary to have Directors with specialized insight and experience not only in the existing interior industry but also in the entire value chain, including materials and construction. |

| Development/Quality | Innovative product development and design, as well as the provision of quality that ensures security and safety, are important factors for business continuity and expansion. Therefore, it is necessary to have Directors with extensive insight and experience in development and quality. |

| Sales/Marketing | In order to provide high-quality solutions from a market-in perspective, it is necessary to have Directors who are knowledgeable about the domestic and overseas market environment and relationships with stakeholders such as customers and business partners, and who have extensive insight and experience in formulating and executing sales strategies. |

| Supply chain management | In a business model that provides a wide variety of products to accurately meet diverse market and customer needs, optimal supply chain management is essential, and Directors with such specialized insight and experience are necessary. |

| Global business | It is essential to expand our business model and capture growth in large overseas markets, and therefore it is necessary to have Directors with extensive insight and experience in global business. |

|

Business model innovation and |

In order to transform into a Space Creation Company, it is necessary to accelerate the expansion of business domain and the creation of new businesses. It is necessary to have Directors with multifaceted and extensive insight, experience, and a mindset for innovation and transformation. |

Reasons for the appointment of Directors

|

Name |

Reasons for the appointment |

Attendance rate of Board of Directors’ meetings in FY2024 |

|

Yasumasa Kondo |

Reasons for nomination as candidate for Director |

(14/14) |

|

Yutaka Matsuo |

Reasons for nomination as candidate for Director |

ー |

|

Michiyo Hamada |

Reasons for nomination as candidate for Outside Director serving as Audit and Supervisory Committee Member |

(14/14) |

|

Kenichi Udagawa |

Reasons for nomination as candidate for Outside Director serving as Audit and Supervisory Committee Member |

(14/14) |

|

Osamu Terada |

Reasons for nomination as candidate for Outside Director serving as Audit and Supervisory Committee Member |

(14/14) |

|

Aki Ogane |

Reasons for nomination as candidate for Outside Director serving as Audit andSupervisory Committee Member |

(11/11) |

|

Yosuke Mine |

Reasons for nomination as candidate for Director serving as Audit and Supervisory Committee Member |

(11/11) |

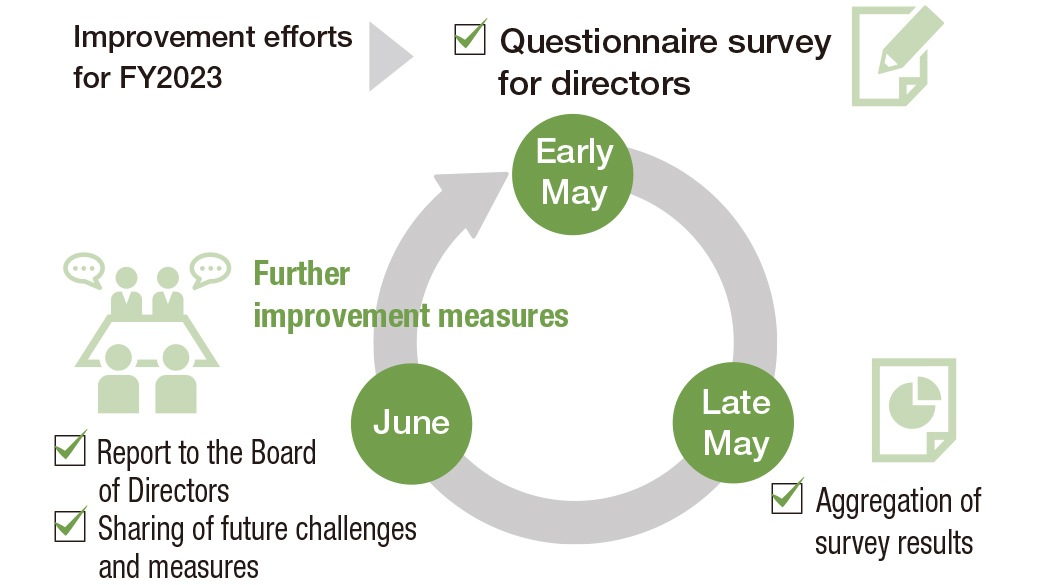

Evaluation of the effectiveness of the Board of Directors

Sangetsu ensures the effectiveness of the decision-making, supervision, deliberation, and all other processes of the Board of Directors. Assessing the effectiveness of the Board of Directors once a year, each Director conducts a self-assessment of the Board of Directors, which is followed by an analysis and assessment of the effectiveness of the Board as a whole. The survey covers a broad range of assessment criteria, from the composition of the Board to the quality of discussions and dialogue with stakeholders. A questionnaire survey was administered to all Directors in May 2024 for FY2023, and the assessment results are being discussed by the Board of Directors. Through these surveys, we aim to improve the effectiveness of the Board of Directors.

Method used to evaluate the effectiveness of the Board of Directors in FY2023

Main evaluation items and the results

- Although progress regarding the medium-to long-term business plan is being verified and detailed explanations are being provided to shareholders, opportunities for more in-depth discussion and verification will be created.

- While appropriate themes are being deliberated and discussed at Board of Directors meetings, the scope of discussion will be expanded to promote discussions regarding the progress of business and growth strategies.

- Although explanations from the executive team are given in sufficient detail at Board of Directors meetings and deliberations are carried out, more opportunities for Outside Directors to check the details and status of business will be created.

- Internal controls and risk management systems, including those for the overall Group, are functioning properly and the status of their operation is understood.

Standards of independence for outside directors

For appointing outside directors, Sangetsu applies its own Standards of Independence in addition to independence criteria defined by the Companies Act of Japan and the Stock Exchange. The Company emphasizes advanced expertise and a wealth of experience to provide candid and constructive advice on company management.

1. Individuals for whom none of the following currently applies:

- a shareholder who owns 5% or more of the voting rights of Sangetsu Corporation or an executive officer of that shareholder;

- an executive officer of a company whose transactions with Sangetsu Corporation exceed 2% of Sangetsu’s consolidated sales or a subsidiary of said company;

- an executive officer of a major lender of Sangetsu Corporation, whose lending to the Sangetsu Group exceeds 2% of Sangetsu’s consolidated total assets as of the most recent fiscal year end;

- a certified public accountant who belongs to Sangetsu Corporation’s accounting auditor;

- a consultant, accounting expert, or legal expert who receives an annual sum of 10 million yen or more in monetary or other benefits from Sangetsu Corporation in addition to remuneration paid by Sangetsu as well as in the event the recipient of such benefits is a corporation or organization or any individual who belongs to such a corporation or organization;

- an executive officer of an organization that receives an annual sum of 1 million yen or more in donations from Sangetsu Corporation;

- a second-degree relative of an individual who falls under any of the above-mentioned (1) to (6); and

2. An individual for whom none of the above-mentioned (1) to (7) applied at any point in the past three years.

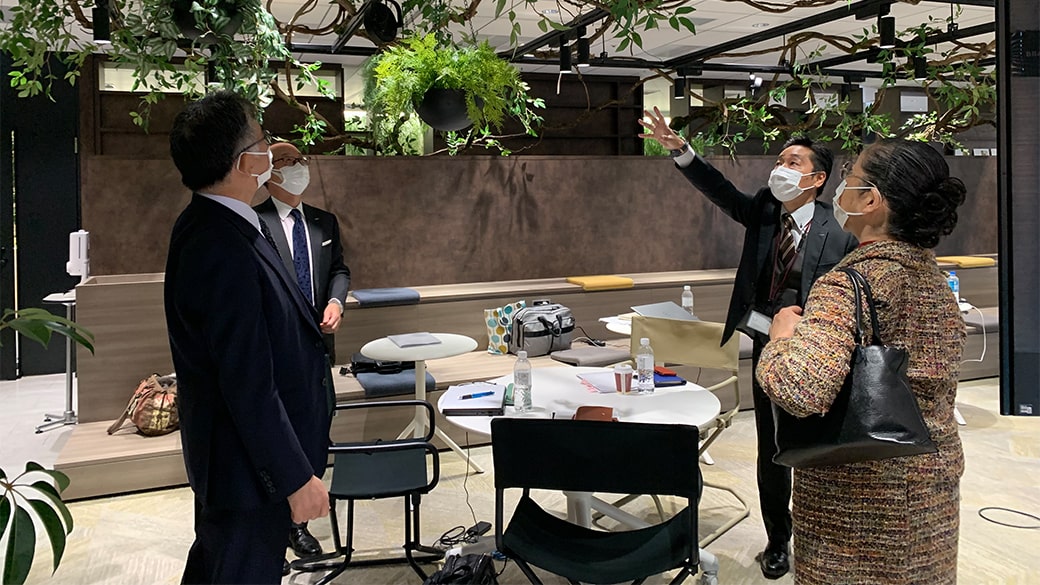

Training, etc. for Directors

On-site visit to the Kansai Branch, which was relocated in December 2021

In order to promote compliance management, opportunities for Directors and senior management to participate in internal and external training are provided, and the Company covers the costs of participating in training sessions hosted by third-party organizations.

Audit and Supervisory Committee

The Audit and Supervisory Committee consists of four outside directors and one full-time internal director. These members primarily conduct audits using the internal control system and through on-site visits to business sites worldwide. The committee seeks to strengthen the effectiveness of its audits by gathering and sharing valuable information through the periodic exchange of views with the President and CEO, reports presented by Executive Officers and employees, liaison meetings of audit committee members at affiliated companies, and other means.

Activity status of the Audit and Supervisory Committee

- Dialogue with management executives 33 meetings * Results for FY2023

Sangetsu has created opportunities for the Outside Directors to engage in a dialogue with Executive

Officers, Presidents of each Group companies, and General Managers. - Participation in 46 important meetings * Results for FY2023

Outside Directors participate in not only Board of Directors meetings but also Business Strategy Conferences and other important meetings to contribute to executive-level decision making. - Participation in 53 visiting audits * Results for FY2023

Outside Directors conduct on-site visiting audits to obtain real-world information on each site.

Nomination and Remuneration Committee

The Nomination and Remuneration Committee consists of the President & CEO and all independent outside Directors who are Audit and Supervisory Committee Members. This committee supervises the training plans for successor candidates, determines the specific amount of remuneration for officers, and transparently provides proposals and explanations to the Board of Directors. It devotes sufficient time and resources to the appointment and dismissal of the CEO, directors, and executive officers, and selects individuals who possess the necessary objectivity, transparency, and timeliness to recommend to the Board of Directors. In addition, if the committee recognizes that the CEO is not adequately fulfilling their role, it will recommend their dismissal to the Board of Directors in a timely manner. It also evaluates the performance of directors who will serve as executive officers and members of the Board of Directors for the next fiscal year, evaluates personnel and executive officers who do not serve as directors, and deliberates the state of the officer remuneration system, as well as the appropriateness of remuneration levels.

Activity status of the Nomination and Remuneration Committee

| Name | Full-Time / Outside | Attendance Status (16 meetings in total) |

Specific details of discussion |

| Michiyo Hamada | Outside | 16 |

|

| Masatoshi Hatori | Outside | 16 | |

| Kenichi Udagawa | Outside | 16 | |

| Osamu Terada | Outside | 16 | |

| Shosuke Yasuda | Full-Time | 13 |

Notes: Masatoshi Hatori resigned as of the 72nd Ordinary General Meeting of Shareholders held on June 19, 2024.

Shosuke Yasuda retired as of the 72nd Ordinary General Meeting of Shareholders held on June 19, 2024.

Succession Plan

At the Sangetsu, the Nomination and Remuneration Committee monitors the status of development of successors for the CEO and others based on our corporate philosophy and specific management strategies, and discusses candidates in light of criteria such as personality, reputation, insight, ability to conduct business, management perspective, and awareness of participation in management. The Nomination and Remuneration Committee carries out deliberations concerning the appointment of executive officers and core management members, as well as succession plans for the CEO and other personnel (succession plan, required qualities, steps for selecting candidates, etc.). It also discusses the background for selection of CEO candidates, and provides explanations and proposals to the Board of Directors as necessary.

Development of Successors

In developing successors for senior management positions, we utilize internal selection systems such as leadership training and senior management (executive officer candidate) training. At the same time, outside directors not only participate in the Board of Directors, but also in other important meetings as they consider candidates for executive officers and core management members. We have established a system that provides many opportunities for external directors to understand the character and way of thinking of successor candidates through individual interviews with management executives. This all comes in handy during Nomination and Remuneration Committee discussions.

Important Matters Related to Successor Development

- Consideration of medium- to long-term succession plan for the CEO

- Revision of the requirements and qualities required of the CEO as appropriate

- Consideration of medium- to long-term candidates for executive officers and core management members

- Diversification of opportunities to check up on the development of successors within a certain timeline

Message from Nomination and Remuneration Committee Chair

Michiyo Hamada

Outside Director

Chairman of the Nomination

and Remuneration Committee

In 2015, Sangetsu established a Nomination and Remuneration Committee with the aim to ensure transparency and objectivity regarding human resources and remuneration for officers. The duty of this Committee is to discuss the nomination and remuneration of Directors and Executive Officers and to make proposals to the Board of Directors. It could be said that this Committee has a crucial role in the Board of Directors to fulfill its supervisory functions. The central duties are the selection of the successor to the President & CEO as well as the determination of the timing at which a new President & CEO is appointed. Sangetsu has established, through regulations, that the Chairperson of the Nomination and Remuneration Committee is appointed among Outside Directors through mutual election and that the Chairperson of the Nomination and Remuneration Committee acts as the Chair. These regulations are particularly relevant to the execution of the central duties of the Chairperson.

The Nomination and Remuneration Committee has been actively tackling this issue since two years ago. Also, during this year, the Committee has concentrated on discussions and has determined the new President & CEO. A resolution of the Committee was approved by the Board of Directors and, on April 1, 2024, Yasumasa Kondo was appointed as the new President &CEO and Shosuke Yasuda resigned the position.

Yasuda, since he was passed the baton by Yuichi Hibi in 2014, has engaged in the management of Sangetsu with the unique ability and aspirations, and has carried out innovations that could be called the “third founding” while touting lofty objectives. This in itself made it difficult to select a successor for Yasuda. Since my appointment as Chairperson of the Nomination and Remuneration Committee in 2021, I have been firmly aware of the weight of my central duties as Chairperson, and we were impressed by our achievement of the two-year project.

Following the change of President & CEO in April 2024, Sangetsu has been operating smoothly under the new Kondo system. For ten years, Yasuda has been encouraging all employees to build up their own strengths in their responsibilities of management and to continue taking on challenges to achieve lofty objectives. The large number of employees who achieved growth under the Yasuda system have solidified those around the new President & CEO, Kondo, and support the new system.

For the Nomination and Remuneration Committee, the immediate role in the meantime is providing the necessary advice while watching from the background, in order to further advance business with every employee, beginning with the President & CEO and Executive Officers, combining their capabilities.

Recently, listed companies in Japan have begun efforts to improve the supervisory functions of their Board of Directors. It goes without saying that the establishment of a Nomination and Remuneration Committee is necessary, so we would like to learn from excellent examples at other companies. On the other hand, if we at Sangetsu continue to increase our corporate value, our progress in strengthening the supervisory functions of the Board of Directors will be an excellent example that other companies would like to use as a reference.

At Sangetsu, the execution side and supervisory side exhaust efforts to improve corporate value while continuing to maintain tensions and trust.

Highly transparent compensation system linked to performance and shareholder value

[Graph 1] Multiplier by Positions (by Remuneration)

![[Graph 1] Multiplier by Positions (by Remuneration)](/english/assets/img/sustainability/governance/img_corporate_governance_06.jpg)

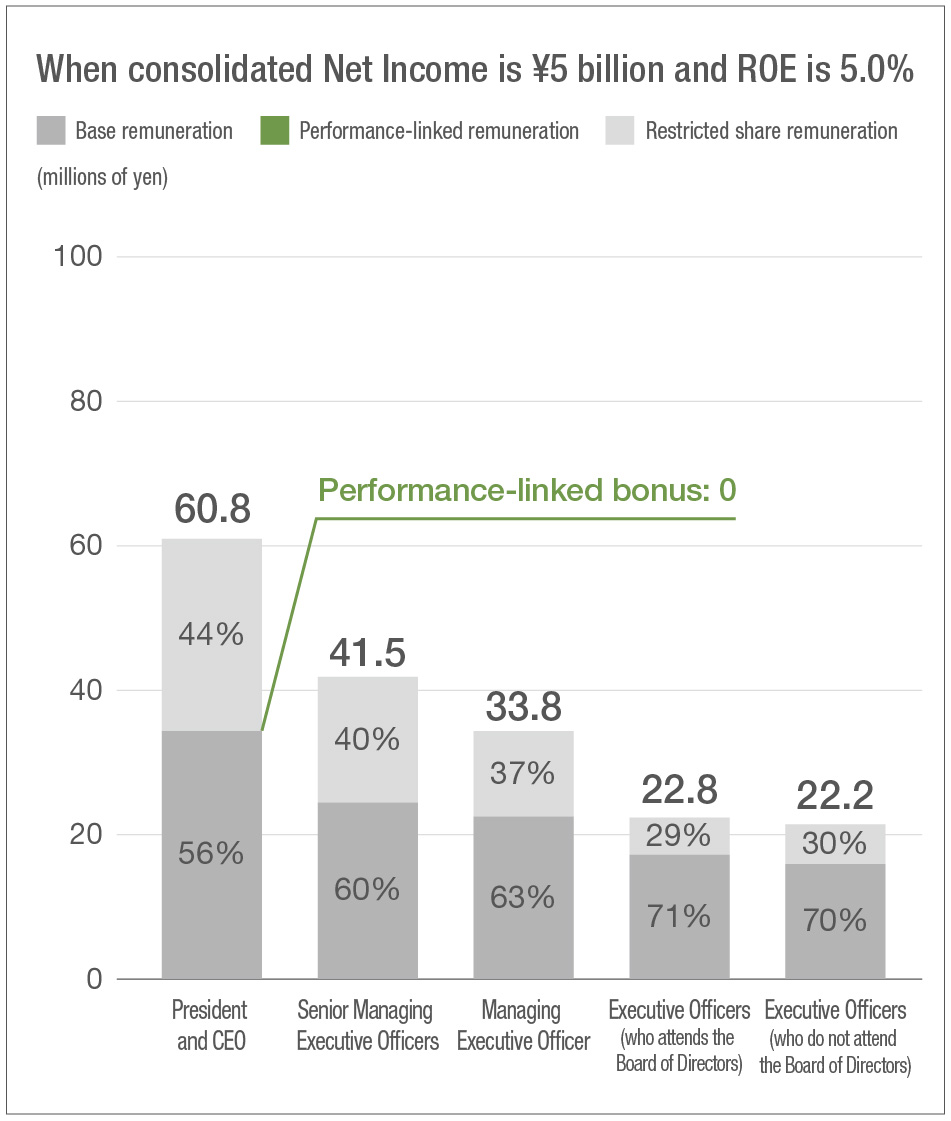

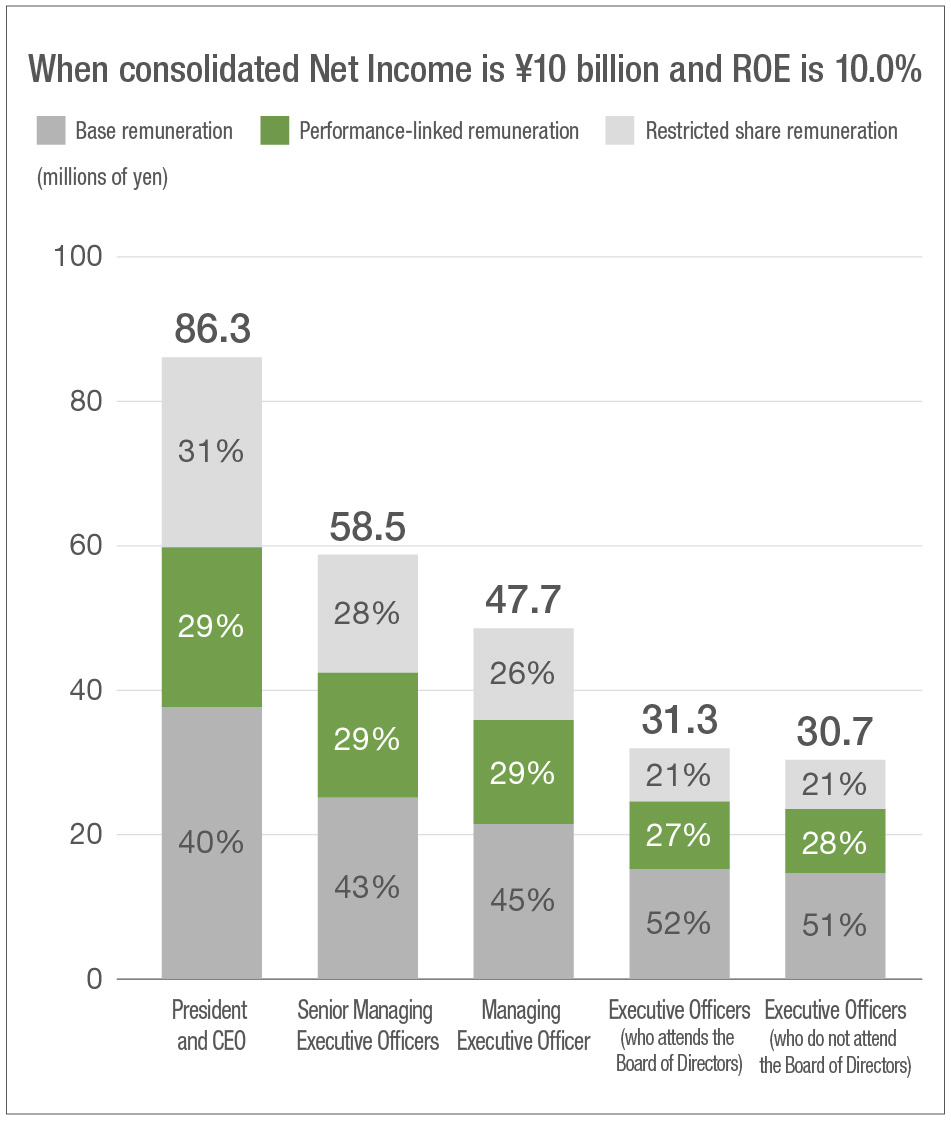

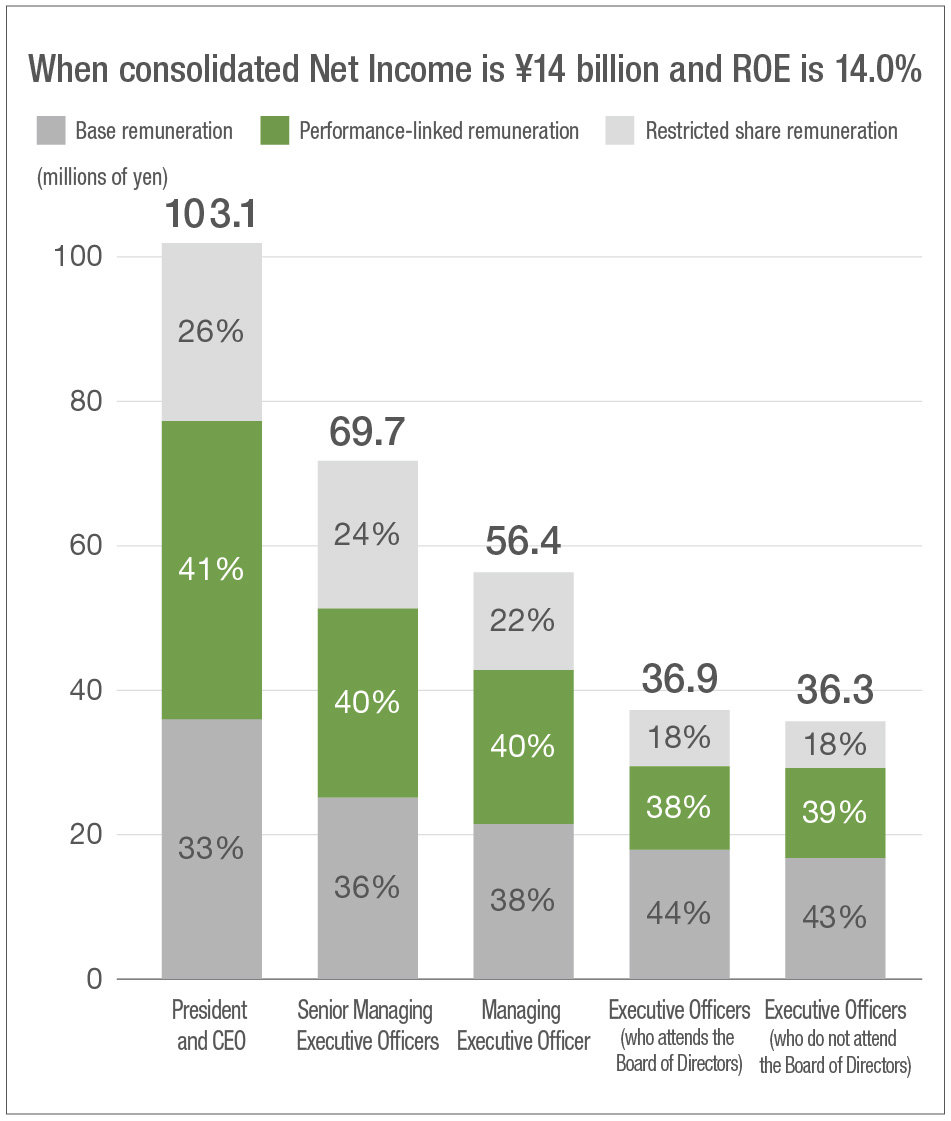

The Company’s remuneration system consists of (1) base remuneration, (2) performance-based remuneration, and (3) restricted share remuneration, and the remuneration of Directors who do not hold concurrent positions as Executive Officers and Directors serving as Audit and Supervisory Committee Members shall be limited to base remuneration.

For base remuneration for those Directors who hold concurrent positions as Executive Officers and for Executive Officers, the Nomination and Remuneration Committee evaluates each individual’s contribution to the business for the relevant fiscal year and determine a contribution evaluation coefficient between 0.85 and 1.25, and calculate the remuneration.

Performance-based remuneration is paid with the aim of improving capital efficiency(ROE) on a single-year basis, using consolidated net income as the linked indicator.

For restricted share remuneration, the number of shares applicable to the period of the current Medium-term Business Plan is determined and paid, with the objective of promoting shared values with shareholders and clarifying incentives to sustainably enhance corporate value.

The calculation formula for each type of remuneration is as follows.

The percentage of performance-based remuneration and restricted share remuneration in the total amount of remuneration increases as the position becomes more senior.

Table 1: Details of each remuneration system

| Base remuneration | (Calculation formula) Base remuneration = standard basic remuneration x contribution assessment scale factor x multiplying factor by position

|

|---|---|

| Performance linked remuneration | (Calculation formula) Performance-linked remuneration = standard amount per Executive Officer x multiplying factor by position

|

| Restricted share remuneration | (Calculation formula) Restricted share remuneration (number of shares) = standard number of shares of Executive Officers x multiplying factor by position

|

[Table 2] Amount of Performance-linked Remuneration for Executive Officers

| Consolidated Net Income (ROE) * | Amount of performance-linked remuneration (X = consolidated net income) |

| ¥5 billion or less (ROE 5.0% or less) | ¥0 |

| More than ¥5 billion and less than or equal to ¥10 billion (ROE of more than 5.0% and less than or equal to 10.0%) | (X - ¥5 billion) x 0.17% |

| More than ¥10 billion and less than or equal to ¥14 billion (ROE of more than 10.0% and less than or equal to 14.0%) | (¥10 billion - ¥5 billion) x 0.17% + (X - ¥10 billion) x 0.14% |

| More than ¥14 billion and less than or equal to ¥18 billion (ROE of more than 14.0% and less than or equal to 18.0%) | (¥10 billion - ¥5 billion) x 0.17% + (¥14 billion - ¥10 billion) x 0.14% + (X - ¥14 billion) x 0.10% |

* Shareholders’ equity = calculate each consolidated Net Income according to each ROE with a base of ¥100 billion

Amount of remuneration and its proportion by title

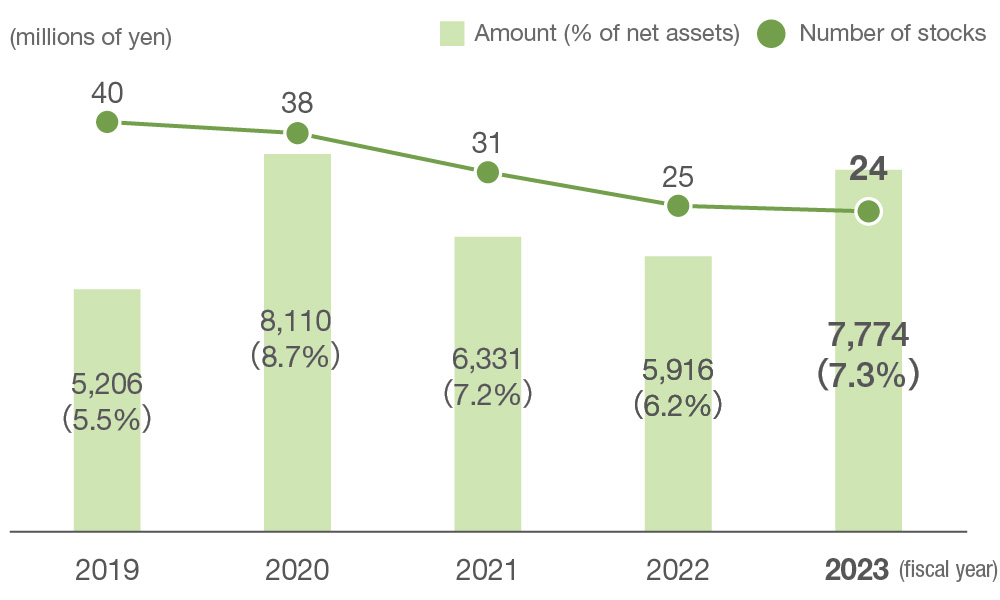

Cross-shareholdings policy

As a business strategy, the Company determines its cross-shareholdings policy for shares held in the medium to long term following comprehensive determinations made from perspectives such as companies with which we should strengthen new relationships and companies with whom we already have relationships that we should continue to strengthen. To determine whether or not we should continue to possess shares of a company, the company we invested in establishes a representative department to confirm the necessity for us to continue possessing the shares of the company with regards to business strategies, by considering factors such as changes in our relationship. Our policy is that the Finance & Accounting Department confirms the costs and returns associated with possessing the shares, the Executive Department, based on that information, makes a determination regarding the significance of possessing those shares in the medium to long term, and those shares are to be sold when there is not a significant reason to possess them. This is reported at the Board of Directors. If the sale has been determined, we will proceed in the sale following dialogue with the company that we invested in. In the fiscal year ending March 31, 2024, the ratio of such shares among our net assets increased due to increases in the share prices. However, we are steadily decreasing the number of companies for which we possess shares and are promoting management that considers asset efficiency.

Trends in cross-shareholdings

Standard for exercising of voting rights

With respect for the management policies of the companies that we are invested in, we engage in meetings and communications through various channels to make comprehensive determinations based on the company’s medium- to long-term improvements in corporate value, status of shareholder returns, and initiatives regarding corporate governance and CSR. Also, we determine the pros and cons following individual close examinations about whether or not the proposed issues are compatible with our own goals and whether or not those issues would improve the corporate value of the company in question.

Strengthen IR and SR

Sangetsu, in order to achieve sustainable growth and improve corporate value over the medium to long term, aims to construct relationships of trust through constructive meetings with shareholders and investors. In order to increase transparency of our company management, our public disclosures are not limited to statutory disclosures in accordance with disclosure policies, but also include prompt and appropriate disclosure of information according to the expectations of an interest in the Company. Also, the Public & Investor Relations Section of the President’s Office functions as a department specializing in IR activities and coordinates with departments such as Finance & Accounting Department, Corporate Planning Section of the President’s Office, and ESG Promotion Section to make efforts to provide information in a more efficient manner, while the Representative Director and President, responsible Executive Officers, and other staff participate in interviews where necessary. These are part of our efforts to have society appropriately assess the corporate value of the Company.

In FY2023, we held two accounting/corporate strategy explanatory seminars, attended by the Representative Director and President, for institutional investors. We published video of the event as well as the event materials, script, and other documents in Japanese and English. Moreover, we have also published, on our website, the contents of meeting events held with analysts, institutional investors, and Audit and Supervisory Committee Members based on the theme of improving corporate value in the medium to long term. Through such activities, we are increasing the number of individual meetings that we have with analysts and institutional investors inside and outside Japan. In addition to participating in IR events for individual investors and disclosing a broad range of information such as through ads in stock information magazines, we have been conducting company information events for individual shareholders since 2017.

These events are attended by all Directors, and the Representative Director and President provides explanations about the Company.

The opinions that we obtain through these activities and meetings are shared by the Public & Investor Relations Section with the Board of Directors and to the responsible persons such as the Business Div. every quarter. We use these opinions to expand the scope of our information disclosure and to improve our management with the aim to improve our corporate value.

Through our Medium-term Business Plan [BX 2025], which we published in May 2023, we are promoting improvements to management while utilizing the plan in our actual business operations by, for example, reflecting the opinions obtained from shareholders through meetings into our policies regarding returns to shareholders.

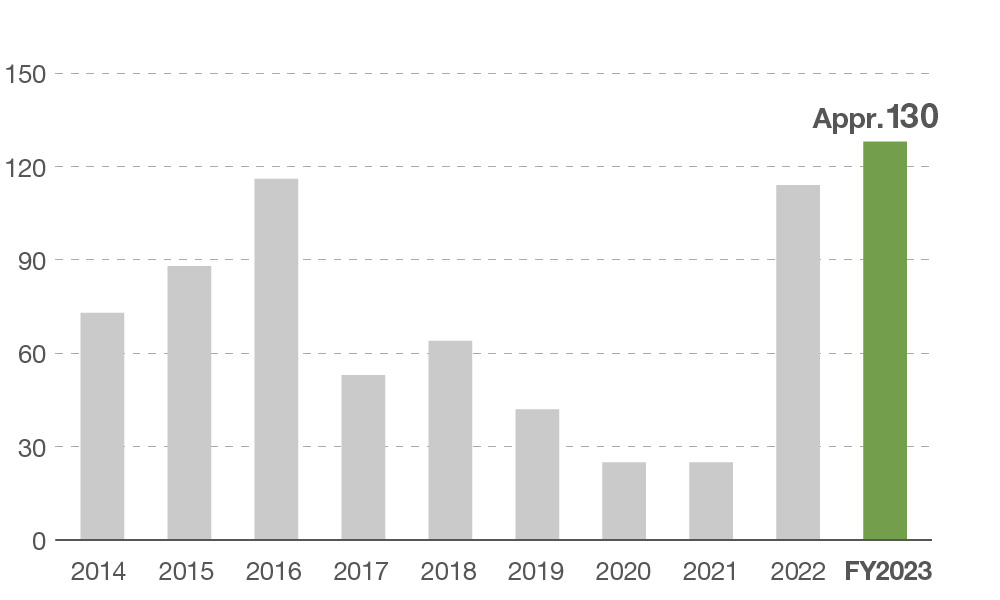

Number of individual interviews with analysts and institutional investors (inside and outside Japan)

Status of IR/SR meetings (FY2023 results)

- Meetings with individual shareholders and investors

Company briefing for individual investors: 1 time (Attended by Representative Director and President)

Company briefing for shareholders: 1 time

(Attended by Representative Director and President, Outside Directors, Executive Officers, etc.) - Meetings with institutional investors Accounting/corporate strategy explanatory seminar: 2 times

(Attended by Representative Director and President, responsible Executive Officers, etc.) Individual interview with analysts and institutional investors (inside and outside Japan): approx. 130 times

Symposium for analysts, institutional investors, and Audit and Supervisory Committee Members: 1 time

Symposium for analysts, institutional investors, and Audit and Supervisory Committee Members

Related Links