Business risks

The matters recorded in the annual securities report concerning the overview of business, financial information, etc. include the following key risks that are recognized by the management as having the potential to exert a material impact on the financial position, operating results, and cash flows of consolidated companies.

Please note that matters concerning the future in this article were determined by the Group as of the end of the fiscal year ended March 31, 2025.

Approach to risk management and

risk management system

The Group strives to maximize corporate value and minimize the impact on management and operations by responding appropriately and promptly to various risks.

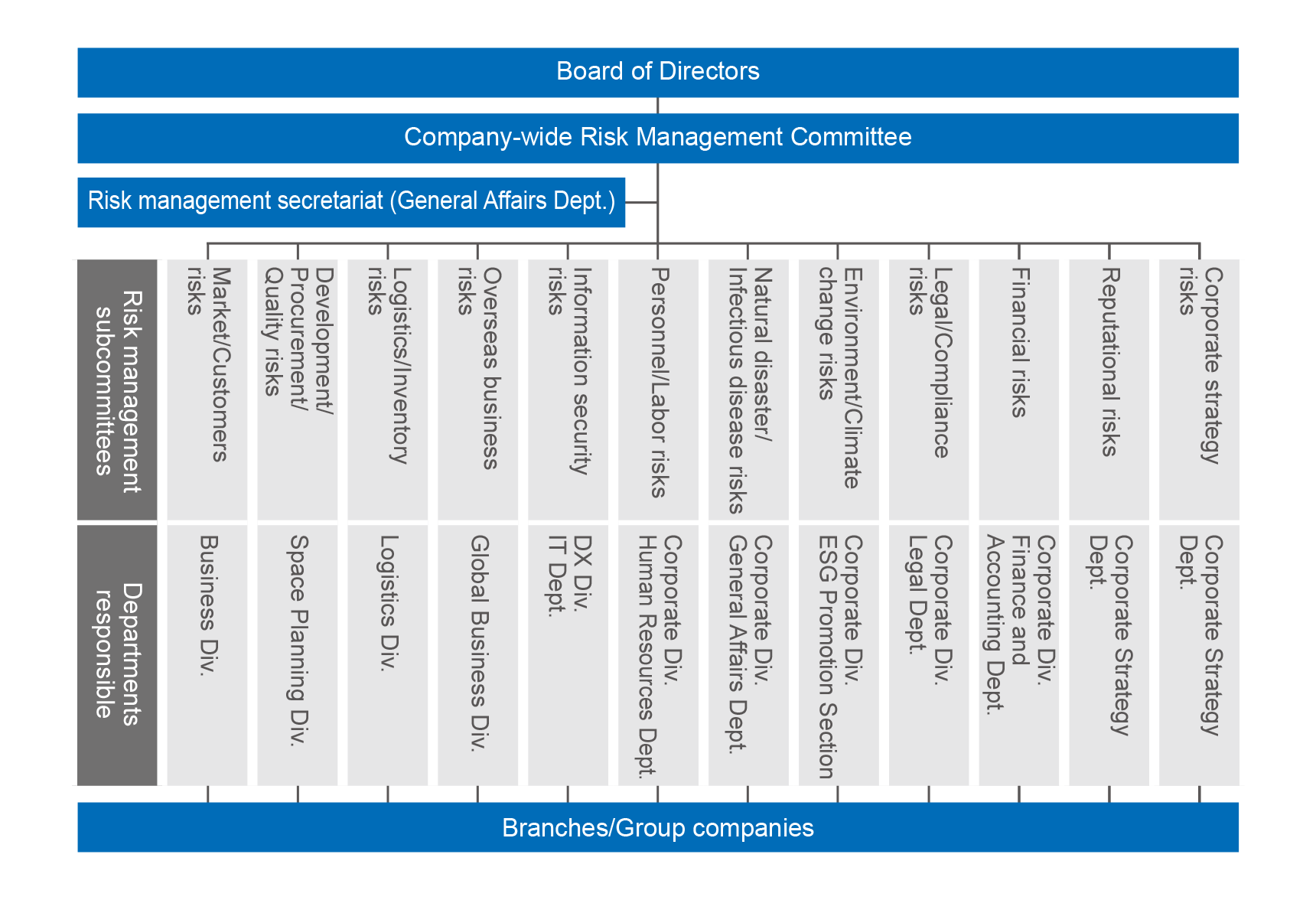

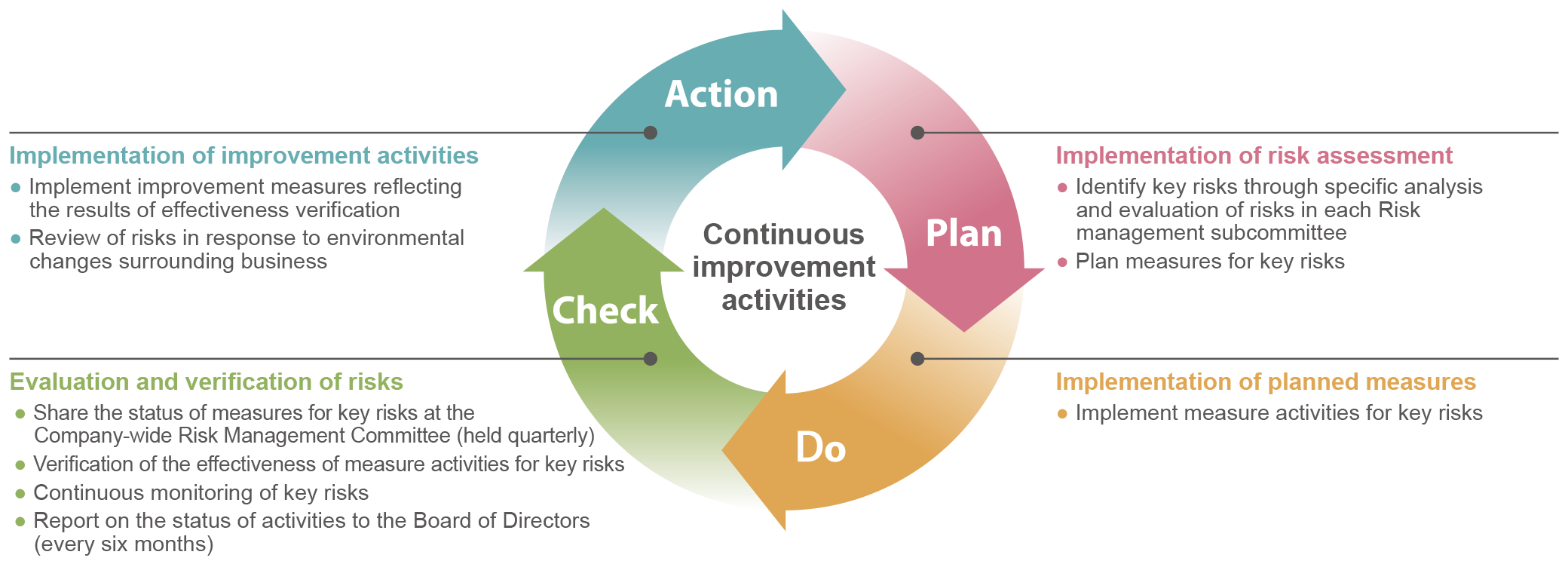

The Company’s risk management system is managed by the Company-wide Risk Management Committee, for which the President & CEO has ultimate responsibility. We strive to maintain and enhance the corporate value of the entire Group, minimize the impact of risks when they arise, and manage various risks that may affect the Company’s activities and employees. The Company-wide Risk Management Committee meets once every quarter to establish basic policies and systems for overall risk management and has functions such as forming task forces as necessary. Activity status is reported to the Board of Directors once every six months, and management is able to exercise decision-making based on an accurate understanding of existing risks. We have identified and clearly defined risks that need to be continuously monitored and addressed from various perspectives, from those that are already partially apparent to those that are not yet apparent. Each risk management subcommittee identifies foreseeable risks, evaluates them using mapping, and clarifies the risks that require priority measures.

【Organization chart】

【PDCA for risk management】

Major risks of the Group

Business environment

Description of risk

The Group operates its business through the Domestic Interior Segment, which in addition to planning and selling interior products such as wall coverings, flooring materials, and fabrics (curtains and upholstery) and manufacturing wallpaper, also conducts design and proposals through to interior and architectural installation; the Domestic Exterior Segment, which sells exterior products such as gates, fences, and carports, and proposes and constructs exterior spaces; and the Overseas Segment, which manufactures wallpaper in the United States, sells interior materials in the Pacific Rim region of North America, China, Hong Kong, and Southeast Asia, and conducts space design, general construction, etc. in Southeast Asia. Since these businesses are dependent on construction demand, there is a risk of losing business opportunities due to factors such as the overall trends of the national economy, government policies regarding housing, changes in the tax system, and a decrease in the number of new residential and non-residential construction starts due to a declining population, as well as a decrease in the contract market due to economic downturn.

Measures against risk

In the domestic market that is the foundation of our business, we do not expect to see significant growth in new construction and renovation in the residential and non-residential sectors in the future due to the declining birthrate and aging population, and we are focusing on our medium-term strategy of expanding our market share and improving income through price revisions under the background of reorganizing and improving our various domestic business foundations, while our long-term strategy is to expand our domestic Exterior Business and to profitably expand our Overseas Business. In terms of procurement, we are working to avoid risks by investing management resources into our manufacturing divisions to ensure stable supply from manufacturers and to facilitate product development from a medium- to long-term perspective. In addition, taking into account the long-term development potential of our current businesses, we have established the Business Creation Promotion Division in April 2024 and focused on creating new businesses in order to explore and implement business development possibilities for further growth.

Quality control

Description of risk

The Group plans, develops, and sells attractive wall coverings, flooring materials, fabrics, and other interior products that are essential elements in living spaces, based on an accurate understanding of customer needs, with the aim of “With all people we collaborate to create peaceful and inspirational spaces.” Except for some products, manufacturing is carried out by external manufacturers of our suppliers, and we receive product supplies from them. However, ensuring product quality is the very “value” that customers require for products, and it forms the foundation for improving reliability as a brand manufacturer, enhancing customer satisfaction, strengthening competitiveness, and increasing corporate value. In addition, for interior products that will be used over a medium term period, it is also important to ensure quality over a long period of time, including changes over time.

Measures against risk

We have defined the product design review process as Design Review (DR-A/B/C) and have established and operated a system in which multiple persons in charge verify and check each stage of development. When developing new products, we utilize the “Quality Requirements Confirmation Sheet” that comprehensively lists items to be verified during the quality verification stage. At DR-A, we identify verification items; at DR-B, we confirm quality and functionality, as well as legal requirements; and at DR-C, we report the verification results. After the product is launched on the market, we identify similar risks in advance and take appropriate measures by analyzing and sharing examples of deficiencies through complaint response meetings for each product group.

In addition, for outsourced manufacturing, we clarify quality standards, outsource the manufacture of products in accordance with quality control standards, and to maintain and improve quality, we manage changes in the four elements that occur at the manufacturing site: “Man” “Machine” “Material” “Method,” and have established a system to evaluate the impact of these changes on product quality through prior reporting and implement appropriate measures to prevent quality issues before they occur.

Stable procurement, stable supply, and BCP of suppliers

Description of risk

The Group conducts sales and marketing activities for wallcoverings and flooring material, which are the main merchandise we handle, by distributing sample books which contain samples of merchandise. As our industry is heavily dependent on maintaining a stable supply throughout the validity period of sample books, interruption to the supply of merchandise due to unforeseen factors such as production problems or raw materials procurement could have an impact on the Group’s business performance.

Measures against risk

In order to ensure the stable procurement of products from manufacturers, we inspect the manufacturers’ factories and check that their manufacturing processes are appropriate before purchasing, and in the event that procurement becomes difficult, we have established an environment as a backup system, such as ensuring sufficient inventory of major merchandise and preparing alternative merchandise. However, considering the impact of the fire that occurred at a factory of one of the Company’s suppliers in December 2024, which resulted in a delay in the supply of some flooring materials, we will review the medium-term procurement strategy and strengthen stable supply in preparation for emergencies.

The Company’s subsidiary, CREANATE Inc., is the largest manufacturer of wallpaper in Japan. As we expand the wallcoverings business, we believe that further development will be possible not only through strengthening our competitiveness and securing volume, but also through improving business efficiency by establishing an integrated manufacturing and sales system, and recognize that maintaining stable factory operation and a stable supply of merchandise is an issue that the entire Group must address. We will further enhance the stability of supply in a planned manner by opening a new CREANATE Inc. factory in Higashi-Hiroshima scheduled to start operation in the fall of 2025.

In addition, to ensure a sustainable supply of merchandise from the Company to our customers, we are strengthening system integration at all stages, from receiving products to receiving orders and shipping, as well as regularly reviewing action plans to address risks that may hinder the stable operation of logistics centers, which serve as inventory hubs in each region, and are working to confirm the effectiveness of and improve countermeasures.

Design and construction business

Description of risk

The Group not only sells interior design materials and exterior materials, but also designs and proposes space designs that utilize these materials, and even operates the business of installation work. In the design and installation business, the business activities must be conducted in accordance with various laws and regulations, including the Construction Business Act, and there are risks to business continuity and reputation if we are judged to have committed a violation, and issues such as securing specialized personnel.

Measures against risk

In order to build and expand highly profitable businesses, in April 2025, we have established the “Space Solutions Group,” which is comprehensively responsible for business planning, space design, construction, sales, project management, and marketing in the field of space creation, and have established a system to thoroughly manage risks related to the construction functions of the entire Group. In addition, we are constantly working to improve our operations by recruiting and training experienced personnel with specialized knowledge and securing the certified skilled workers for picture mounting in the space solutions business, reviewing and considering the systematization of workflows, and conducting thorough internal supervision from a legal perspective.

Logistics function

Description of risk

The Group operates businesses that stock, ship and deliver goods. Maintaining a delivery network throughout Japan is not only essential for business continuity, but is a function that we consider to be one of the Company’s strengths. However, we recognize that securing drivers, promoting initiatives for improving efficiency in preparation for the 2026 logistics problem and, ultimately, securing stable delivery capacity are major issues due to the 2024 logistics problem and aging population.

Measures against risk

By internalizing logistics functions in a wide area within the Group, we aim to strengthen sustainable logistics functions, including reducing environmental impact, and to build and advance a delivery system that is more responsive to individual regions and a more effective and efficient logistics system that includes procurement logistics. Following the establishment of Kurosukikaku, Corporation in September 2022 (converted to a stock corporation in April 2023), we acquired SDS Corporation, a logistics company, as a subsidiary in April 2025. In addition, we will promote the reduction of manpower in cargo handling operations such as loading and unloading through the introduction of cargo handling equipment, and will gradually implement efficient operations through systemization.

Intellectual property

Description of risk

Under the brand statement of “Joy of Design,” the Group strives to develop merchandise with excellent design and functionality that can provide the “Joy of Design” through the creation of a variety of spaces. However, there is a risk that similar merchandise may be manufactured by other companies.

Furthermore, if a third party alleges infringement of intellectual property rights and a lawsuit is filed, the Group may incur losses such as litigation costs and damages, which could have an adverse effect on business performance.

Measures against risk

We are taking various measures to reduce risks, such as the following.

- We are working to create, protect, and utilize intellectual property by filing applications for and obtaining rights to patents, designs, and trademarks related to our business.

- We constantly monitor the intellectual property information of competitors, share the latest information (patents, designs, trademarks, etc.) within the company, and conduct prior investigations and confirmations when launching products, etc.

- We work closely with external experts such as patent attorneys and lawyers and have created a system for immediately taking measures against risks.

Legal restrictions

Description of risk

Unforeseen changes to laws and regulations may affect the business performance of the Group, which is subject to various legal regulations regarding product liability, intellectual property, the environment, and labor in the course of conducting its business.

Measures against risk

We constantly monitor domestic and foreign laws and regulations to ensure that we comply with them. We also consider compliance to be a minimum requirement for a company, and have established a management system and are working to strengthen employee education.

BCP for natural disasters, etc.

Description of risk

The Group’s facilities related to merchandise development, manufacturing, procurement, logistics, sales, and services are spread throughout Japan and overseas (North America, China, Hong Kong, and Southeast Asian countries), and natural disasters such as earthquakes, floods, storms and heavy snow could cause infrastructure to stop, or buildings and facilities to be damaged or broken, resulting in confusion that could have an adverse effect on the Group’s business performance and financial position.

Measures against risk

In order to minimize the impact of natural disasters on our business activities, the Group has formulated a Business Continuity Plan (BCP) for times of disaster. In it we have specified the initial response to an emergency, reporting methods, and the establishment and role of a response headquarters, and we have established a system to ensure appropriate action in the event of a disaster and also conduct regular training and equipment inspections. We also review the BCP every year in response to the status of disasters. In addition, to ensure the stable procurement and supply of merchandise, we have established a system that enables product procurement and delivery from alternative locations in the event that a party in the supply chain such as a supplier or one of the Group’s business locations is affected by a disaster. Based on the experience gained from system failures that occurred in FY2024, measures have been strengthened more than ever before, and training assuming large-scale system failures is planned in FY2025 to develop an effective BCP scheme.

Climate change

Description of risk

Amid growing interest in the risks of climate change, the Paris Agreement was adopted by the United Nations in 2015, and the Sustainable Development Goals (SDGs) were adopted at the UN Summit held in the same year, which marked progress in the setting of goals targeted at 2030. Meanwhile, in a move related to financial institutions, the Principles for Responsible Investment (PRI), launched by a partnership between the United Nations Environment Programme and the United Nations Global Compact, requires investors to invest sustainably, and in response, Japan’s Government Pension Investment Fund (GPIF) has signed the PRI, making ESG investment a megatrend in Japanese finance as well. Regarding disclosure of climate change-related information, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations call for companies to disclose financial impact in the four areas of governance, strategy, risk management, and metrics and targets.

Amid these dramatic changes in the environment related to climate change, we are faced with the risk of not being able to reduce greenhouse gas (GHG) emissions from our business activities, the risk of not being able to reduce the carbon footprint of our products and sample books, the risk of not being able to collect and recycle the products and sample books, and other physical risks that may occur acutely or chronically, which may affect the business performance and financial position of the Group.

For example, being unable to reduce GHG emissions across the entire supply chain could result in an increase in purchase costs due to increased carbon tax burden, while being unable to reduce the carbon footprint of our products and sample books could mean being unable to meet the market’s needs, which could lead to a decline in trust and loss of business opportunities.

Measures against risk

In response to climate change risks, we have established an Environment/Climate Change Risk Subcommittee under the Company-wide Risk Management Committee that is chaired by the President & CEO, and are building an organizational management system. Under this Environment/Climate Change Risk Subcommittee, each risk related to climate change is analyzed along the lines of transition risks, such as legal regulations and reputation, and physical risks, such as acute and chronic risks. The Space Planning Division, Logistics Division, Business Division, and Corporate Division are working closely together to set specific management indicators and monitor and respond to risks.

In addition, in the Sangetsu Group Long-term Vision [DESIGN 2030], we set out the realization of a sustainable society that protects the global environment, and set FY2029 GHG emission targets for our business activities (Scope 1 & 2) of carbon neutrality (net zero emissions) in the non-consolidated company and a 55% reduction for the entire Group (compared to FY2021). We are striving to reduce GHG emissions through energy conservation activities at production sites with high GHG emissions and the introduction of renewable energy. Going forward, we will strengthen engagement with suppliers to reduce GHG emissions across the entire supply chain and promote the expansion of sales of environmentally friendly products that meet customer needs in order to respond to climate change risks.

Information security

Description of risk

The Group makes significant investments in order to appropriately manage the various confidential information, including personal information, collected through its business activities. In addition, we take maximum precautions to prevent system problems or external leaks of information when operating, introducing, or updating such systems. However, there is a risk of damage from external computer viruses or hacking, the breakdown of computers or network equipment, system failures due to software defects, business suspension due to partial damage to systems caused by a disaster, and incidents such as information leaks to outside parties, and the occurrence of such unexpected problems could damage the trust from society and result in significant expenses, which may affect the Group’s business performance.

Measures against risk

- We are promoting the migration of servers and network equipment to the cloud or data centers and the use of such where appropriate.

- As measures against unauthorized external access and malware, we have introduced the use of intrusion detection and monitoring services and security software.

- Any malware that may affect IT systems is immediately detected and isolated by our EDR (Endpoint Detection and Response) system, and we work with the SOC (Security Operation Center) to deal with the issue swiftly.

- We regularly educate employees about information security (the importance of protecting confidential information, including personal information, and managing information) and provide training.

- We have redundancy in place for important system equipment.

- We have taken out cybersecurity insurance.

- We have enacted personal information protection regulations in accordance with the revised Act on the Protection of Personal Information.

- The above measures are being promoted by the Cyber Security Management Office, which is also working to establish and develop cyber security systems for the entire Group (both in Japan and overseas).

Credit management

Description of risk

The Group provides credit to business counterparties and if a counterparty’s financial condition deteriorates due to an economic downturn or unforeseen circumstances, making it difficult to collect receivables, the Group may incur losses due to bad debts, which may affect the Group’s business performance. We are taking the following measures against these risks, strengthening our credit management system to prevent losses due to uncollectible receivables, and striving to avoid losses due to bad debts.

Measures against risk

- Appropriate implementation of credit management regulations

- Annual update of credit limits based on the credit standing of counterparties

- Regular checking of the business conditions of important counterparties and their financial statements

- Review of business terms with a view to future developments with counterparties

- Timely monitoring of debt collection status

- Review of the turnover period of accounts receivable

- Setting of allowance for doubtful accounts in our accounting for counterparties with credit concerns

- Strengthening management of counterparties with credit concerns and providing sales support

- Implementing credit protection measures such as collateral, guarantees, and trade credit insurance according to the credit status of counterparties

Overseas business activities

Description of risk

The Group conducts business mainly in North America, China, Hong Kong, and Southeast Asian countries, and there is a risk that the following events may affect the Group’s business performance and financial position.

- The spread of an infectious disease, political instability, uncertainty about economic trends, differences in religion, culture or business practices, war or civil strife, terrorism, restrictions on investment, overseas remittances, imports and exports, etc.

- In accordance with accounting standards for impairment of non-current assets, the future cash flows, etc. of assets are calculated and impairment losses are recognized and measured periodically, resulting in the recording of impairment losses on non-current assets.

- The business of a Group company with a manufacturing division experiences extreme fluctuations in the purchase prices of raw materials and merchandise due to a sharp rise in crude oil or mineral prices, etc.

- A sharp increase in transportation costs from Japan and when overseas Group companies procure merchandise from overseas.

- Reputational risks arise due to prolonged product complaints and quality issues, etc.

- We are unable to secure management personnel of the Company and those in local areas to manage overseas Group companies.

Measures against risk

- The Group has been proactively creating an environment within the Group that is prepared for emergencies, including by collecting information on issues that could become political or economic obstacles and formulation of a BCP for unforeseen circumstances.

- The Group has established a system for managing businesses after investment.

- If the cost of raw materials etc. rises sharply, we will implement appropriate price revision while assessing the market and competitive situation. We closely monitor not only our suppliers, but also crude oil prices and price fluctuations among raw material manufacturers, and are constantly preparing to gather information in order to make appropriate decisions regarding purchase price negotiations and sales price revisions.

- We select the most efficient transportation method and charge appropriate shipping fees to our customers.

- We are working to establish a system that thoroughly manages quality control in each country and prevents complaints before they arise.

- We are developing young personnel who will take on overseas business in the medium to long term, as well as developing local management personnel who will be responsible for growing business, developing and maintaining organizational structures for transformation, and expanding profitability.

Securing human resources

Description of risk

We recognize that securing diverse and capable human resources who can execute the management strategy is essential for the Group to achieve sustainable growth and enhance corporate value over the medium to long term. However, due to the declining labor force population and the increasing fluidity of the labor market in Japan, competition for the acquisition of human resources beyond industry and type of business is intensifying. If we are unable to recruit and develop the human resources the Group needs as planned, or if existing excellent human resources leave the companies, there are risks that the execution of business plans will be delayed, which may affect the Group’s operating results and financial position.

Measures against risk

The Group has identified “strengthening human capital” as a key measure in the Medium-term Business Plan [BX 2025] and is actively and systematically promoting investment in human capital. We are strengthening human capital by reinforcing new graduate recruitment and expanding mid-career recruits with high levels of expertise. At the same time, we are working to establish personnel systems that are linked to the business environment, enhance training programs that support employee skill development, career formation, and career self-management, promote DE&I, and develop a workplace environment where diverse human resources can work with peace of mind and fully demonstrate their abilities.

Since FY2023, we have assigned human resources personnel to each organization to carry out detailed human resource management, including career design support and appropriate personnel allocation based on an understanding of each employee. In addition, we are working to improve employee performance by improving employee engagement through the implementation of measures to identify and improve organizational issues using engagement surveys.

We confirm the progress of recruitment plans, the results of engagement surveys, and trends in turnover rates, and conduct risk management.

Related Links