Capital policy

Capital policy

The consolidated results of the Sangetsu Group have been stable and positive since its shares were listed on the stock exchange in 1980. We will promote the continued improvement of capital efficiency based on ROE, create stable cash flow, and continuously improve our cash conversion cycle (CCC) with the goal of maintaining stable earnings.

Medium-term Business Plan (2023-2025) 【 BX 2025 】 capital policy

- We will maintain equity capital in the range of 95 to 105 billion yen as of March 31, 2026. (Equity capital as of the end of March 2023: 95.7 billion yen)

- Shareholder returns will be centered on dividends, and we will aim for stable dividend increases by setting the minimum annual dividend at 130 yen per share.

- We will consider acquiring treasury shares depending on market conditions.

Fund Allocation Plan

![[ Fund Generation and Procurement ] Cash equivalents held as of the end of March 2023* :¥27 billion, Operating cash flow in 3 years: ¥47-51 billion, Change in debts in 3 years: ¥-8 to 6 billion [ Fund Allocation ] Growth investment: ¥20-25 billion, Shareholder Return: ¥25-35 billion, Cash equivalents held as of the end of March 2026: ¥20-25 billion *1 Cash & deposits and securities other than shares](/english/assets/img/ir/management/img_capitalpolicy_01.jpg)

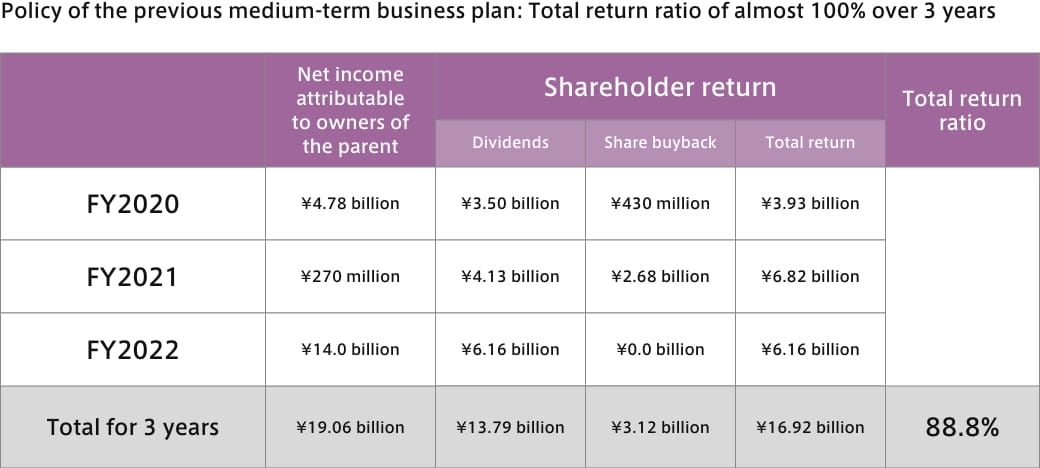

Results of shareholder return: During the Medium-term Business Plan【 D.C. 2022 】

Please refer to the related contents below for the status of shareholder returns and performance trends.

Related Links